Have you been looking for a one-stop-shop payment processing platform designed for the travel industry? “Over here, mate”, shout TravelPay in a very Aussie way (they’re 100% Aussie-owned).

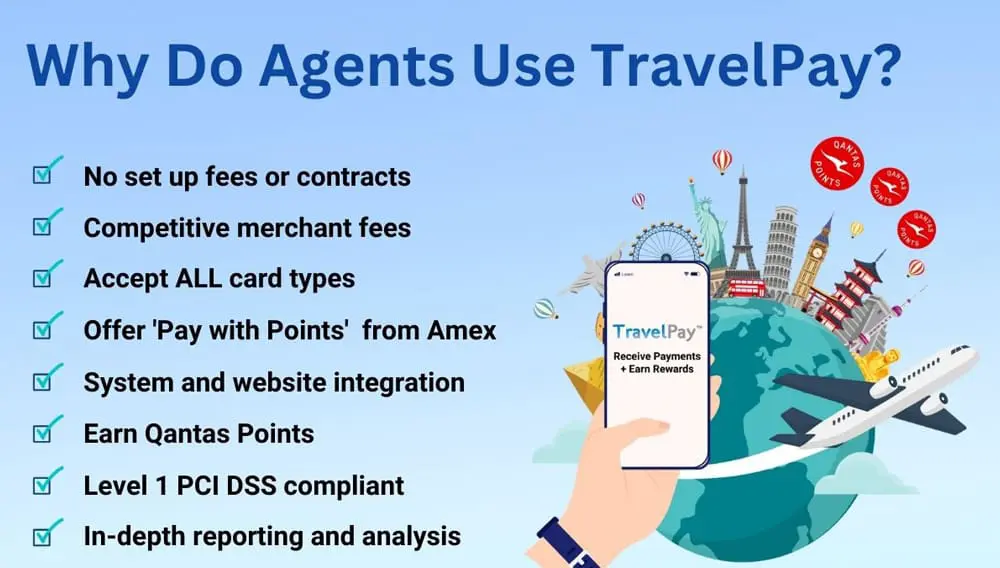

TravelPay is ready to facilitate swift, effortless transactions to enhance your business, offering a range of payment options to your clients and rewards you with every transaction processed with TravelPay. You’ll also earn 20,000 bonus Qantas Points if you start using TravelPay by 31 July 2024!*

TravelPay is more than just a payment processing solution. It’s designed with you and your business in mind. Whether you are collecting payments or protecting against fraud, TravelPay is on it.

With no set-up costs or competitive merchant fees, your branding on the TravelPay payment page and seamless system integration with Tramada, VTO Ultimate and more, it’s never been easier to collect payments from your travel clients.

5 ways to level up your biz

Curious how TravelPay can improve your payment processing, so you’ve got more time to do what you’re best at?

Here are 5 ways TravelPay can help:

#1 Flexible payment options

The warp speed we’re living life these days means the Need for Speed is not just the name of that pretty average 2014 action movie: it’s how your clients and supplies want to engage with you (and you with them).

TravelPay simplifies the payment process, allowing you to efficiently collect payments. Less time spent on manual payment processing means more time working on the fun bit of your client interaction – helping design dream trips!

TravelPay supports flexible payment methods, including credit cards (even American Express), debit cards, PayID, Apple Pay, Google Pay, and TravelPay Later (pay in equal instalments over 6 or 12 months and powered by Latitude). Your customers can even pay with their American Express Membership Reward Points!

This means your customers can pay any way they like.

#2 Unmatched security

Serving over 1,000 Aussie travel agents, TravelPay is Level 1 PCI Data Security Standard compliant. With encryption, tokenisation, and more controll, your financial transactions – and all data – are safeguarded.

TravelPay is backed by Zenith Payments, a leading payment facilitator with over 10 years of experience across many industries, including travel.

#3 Easy integration & automation

TravelPay aligns with many travel management systems, aiding streamlined payment processing and ensuring you have less manual work to do. There are no changes to your bank account or software systems, and the TravelPay team are on hand to ensure seamless integration with partners, including Tramada, VTO, PowerSuite, and more.

Once set up, you’ll receive automated reconciliation reports and detailed financial reports are also available (very handy as the end of financial year draws close), leaving you on top of your transactions and business performance.

TravelPay is continually evolving, and its intuitive and user-friendly interface comes from the dedication of a team that wants your experience with them to be outstanding.

#4 Global payment capabilities

With the rise of work-from-anywhere businesses and employees, being able to process payments when your clients are overseas gives you an edge over the competition.

Accepting payments from around the world is an especially beneficial feature when your clients are overseas.

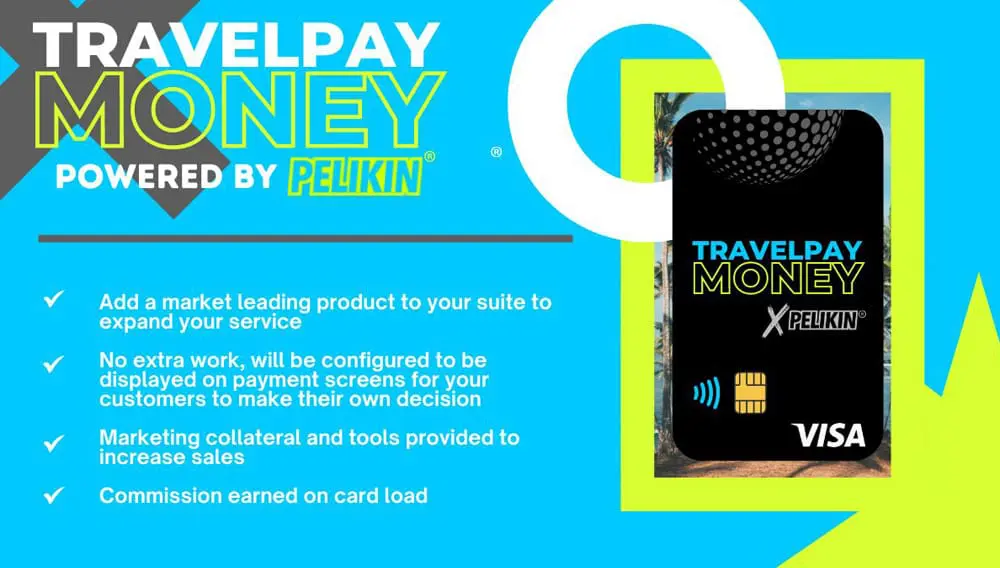

Plus, the addition of TravelPay Money (powered by Pelikin) means your clients can pay like a local in more than 22 currencies and includes a handy app. Agents earn no-effort commission when their clients load money onto their card.

#5 Earn Qantas Points and Other Rewards on EVERY payment received

Who doesn’t love some perks while they work?

With TravelPay, every transaction will earn you 1 Qantas Point for every $20 processed. No tricks, hurdles or hoops to jump through. Yes, you’ll get points you can use towards your own travel when customers are using TravelPay to settle the bill for theirs.

To date, TravelPay members have earned a whopping 65 million Qantas Points!

That’s not all, says Cath Bisaro, Head of TravelPay, “We are focused on rewarding our members. Join TravelPay by 31st July and earn 20,000 bonus Qantas Points. We value our members and reward them for doing business with us.”

You read it right, when you join before 31 July 2024, you’ll score 20,000 bonus Qantas Points* on top of the standard 1 point per $20 deal. Woohoo.

Ready to experience the benefits of TravelPay? Join their secure, flexible and rewarding payment solution and leverage their financial prowess on a platform committed solely to travel agents across Australia. Sign up today!

The deets

To find out more or sign up with TravelPay, head here.

*T&Cs apply. Find them here. *New agents to TravelPay will earn 20,000 bonus Qantas Points when they process at least

$75,000 in card payments by 31 July 2024.

This article is brought to you by: