Qantas is still scrapping more flights than its main competitors, with the airline’s cancellation rate over the June quarter more than double that of Jetstar and Virgin Australia, according to the latest Australian Competition and Consumer Commission (ACCC) Domestic Airline Competition report.

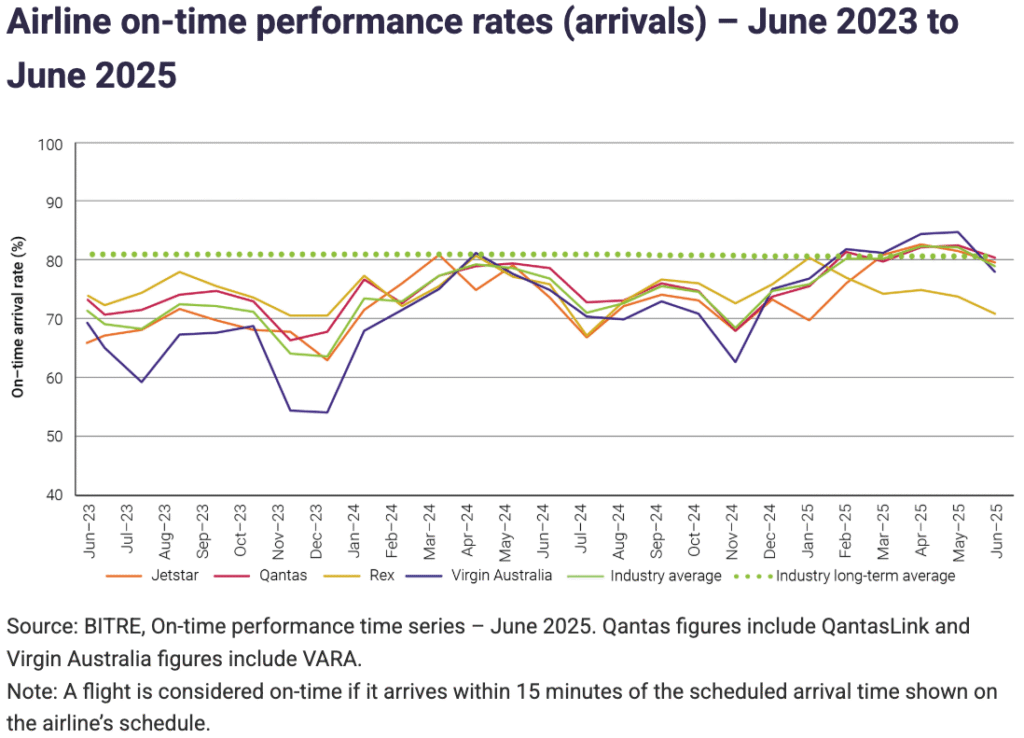

Despite this, overall airline reliability trended in the right direction in the June quarter. Industry-wide, on-time arrivals hit a three-year high in April, with all three major airlines beating the long-term average of 80.7 per cent. Cancellations also fell below the historical 2.2 per cent rate in April and May before inching up to 2.4 per cent in June. Cancelling an impressive 0.7 per cent of services, Virgin and Jetstar led the way in April.

“This improvement in on-time performance is good news for travellers as they can have more confidence that their flight will arrive at their destination at the time they booked,” ACCC Commissioner Anna Brakey said.

“The improved performance follows a collective effort by airlines, air traffic controller Airservices Australia and airports.

“We will continue to closely monitor cancellation rates on all routes and expect airlines to make improvements where cancellation rates are high to minimise disruptions for travellers.”

While the ACCC found that more Australians are back in the skies, with monthly domestic passenger numbers returning to pre-COVID levels, capacity hasn’t caught up. In June 2025, seat supply was still 2.8 per cent lower than June 2019, with the gap partly due to Tigerair’s 2020 exit and reduced regional flying from Rex.

“The withdrawal of Tigerair in 2020 significantly reduced the capacity for low-cost travel from the domestic market,” Ms Brakey said.

While both Qantas and Virgin are expecting fresh aircraft in the second half of 2025, most of these will first replace leased and older planes before adding significant new capacity. However, the Qantas Group will also gain 13 aircraft from Jetstar Asia’s closure, to be redeployed across Australia and New Zealand.

But travellers aren’t paying less for tickets. Despite jet fuel prices falling 12.3 per cent year-on-year, average fares in June 2025 were slightly higher than a year earlier.

“The lack of growth in seat capacity to meet rising demand has likely meant consumers are paying more than they would have in a more competitive, better-supplied market,” Brakey stated.

This quarter’s report also shines a spotlight on frequent flyer programs, with the ACCC urging travellers to weigh up the value they’re getting. Qantas Frequent Flyer now counts 17 million members, while Velocity Frequent Flyer sits at 12.9 million – making loyalty a serious business in Australia’s skies.

“While these programs can offer appealing benefits to consumers, they also come with certain drawbacks that consumers should consider before preferencing a particular airline in pursuit of points and status credits,” the Commissioner said.

“We encourage consumers to look into how frequent flyer programs operate and weigh the potential benefits of frequent flyer points or status credits against the cost of flights when choosing fares.

“Points may lose value, expire or be difficult to redeem. Similarly, airlines can change the number of status credits required to reach or maintain a higher tier.”