The world’s busiest airports offer a snapshot of how global travel works, with their rankings revealing where demand, connectivity and airline capacity (plus congestion?) converge most strongly.

New data from aviation analytics firm OAG ranks the world’s busiest hubs based on total scheduled airline seats across the full 2025 calendar year.

The results highlight which hubs played the biggest role in moving travellers, supporting airlines and shaping global travel flows.

Last year, Atlanta Hartsfield-Jackson once again topped the list. The US hub offered 63.1 million seats across domestic and international services, maintaining its lead from 2024 and remaining close to pre-pandemic capacity levels.

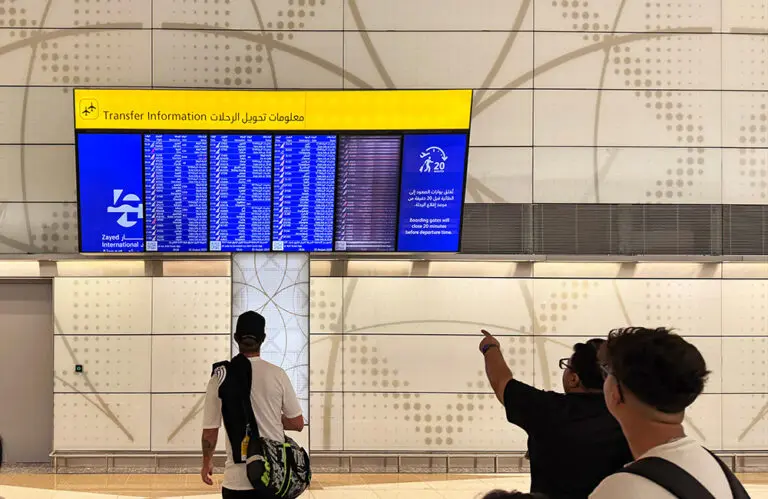

Dubai International Airport ranked a close second worldwide with 62.4 million seats. While Atlanta retained the annual title, the Gulf airport continued its strong upward trajectory, delivering 4% year-on-year capacity growth.

That momentum is also clear in the longer view. Dubai’s total seat capacity now sits 16 per cent above 2019 levels, reinforcing its position as a central global hub linking Europe, Asia, Africa and Australasia.

With 55.4 million seats, Tokyo Haneda placed third. Capacity remained stable compared to 2024 and slightly above pre-pandemic levels, reflecting consistent demand in Japan’s domestic and regional markets.

Several airports posted notable gains compared to 2019.

Istanbul Airport climbed into fifth place globally, with total capacity now 22 per cent higher than before the pandemic.

Dallas Fort Worth, Guangzhou Baiyun and Denver International also entered the global top ten.

With seat capacity up 24 per cent, Denver recorded the largest growth against 2019, underscoring the strength of the US domestic market.

Looking specifically at international travel, Dubai again led the world. The Emirati hub retained its position as the busiest global airport with 62.4 million international seats, well ahead of its nearest rivals.

London Heathrow ranked second internationally with 49 million seats, followed by Seoul Incheon, Singapore Changi and Hong Kong International.

Hong Kong delivered the strongest year-on-year growth among the top ten, increasing capacity by 12 per cent.

While no Aussie airports make the cut, some of Australia’s major hubs have recently reported record passenger growth, like Melbourne Airport and Gold Coast Airport.

Busiest airports of 2025

| Rank 2025 | Airport | Seats 2025 | 2019 Rank | 2025 vs 2019 | 2024 Rank | 2025 vs 2024 | Dominant Carrier | Dominant Carrier Share |

| 1 | Atlanta Hartsfield-Jackson | 63,091,615 | 1 | 0% | 1 | 1% | Delta Airlines (DL) | 78% |

| 2 | Dubai International | 62,425,105 | 4 | 16% | 2 | 4% | Emirates (EK) | 57% |

| 3 | Tokyo Haneda | 55,357,501 | 3 | 1% | 3 | 0% | All Nippon Airways (NH) | 40% |

| 4 | London Heathrow | 52,106,597 | 7 | 4% | 4 | 1% | British Airways (BA) | 45% |

| 5 | Istanbul Airport | 51,508,283 | 16 | 22% | 7 | 6% | Turkish Airlines (TK) | 80% |

| 6 | Dallas Dallas/Fort Worth | 51,243,321 | 13 | 17% | 5 | -1% | American Airlines (AA) | 82% |

| 7 | Shanghai Pudong | 51,073,166 | 8 | 9% | 8 | 5% | China Eastern Airlines (MU) | 30% |

| 8 | Chicago O’Hare | 50,579,340 | 6 | 0% | 10 | 8% | United Airlines (UA) | 47% |

| 9 | Baiyun | 50,177,572 | 12 | 11% | 9 | 3% | China Southern Airlines | 47% |

| 10 | Denver | 49,491,795 | 21 | 24% | 6 | 1% | United Airlines (UA) | 49% |

KARRYON UNPACKS: For travel advisors, these rankings highlight where airline capacity is strongest, where schedules are densest and where global hubs continue to anchor itineraries for Australian travellers.