Travellers Choice officially launches its newest training program, ProAdvance, with 12 advisors, including three agency owners, on board as the first participants for the future leader initiative.

Introduced at the 2025 Travellers Choice Conference in December, the initiative aims to provide a career pipeline for senior travel advisors to business leaders and a succession plan for network members.

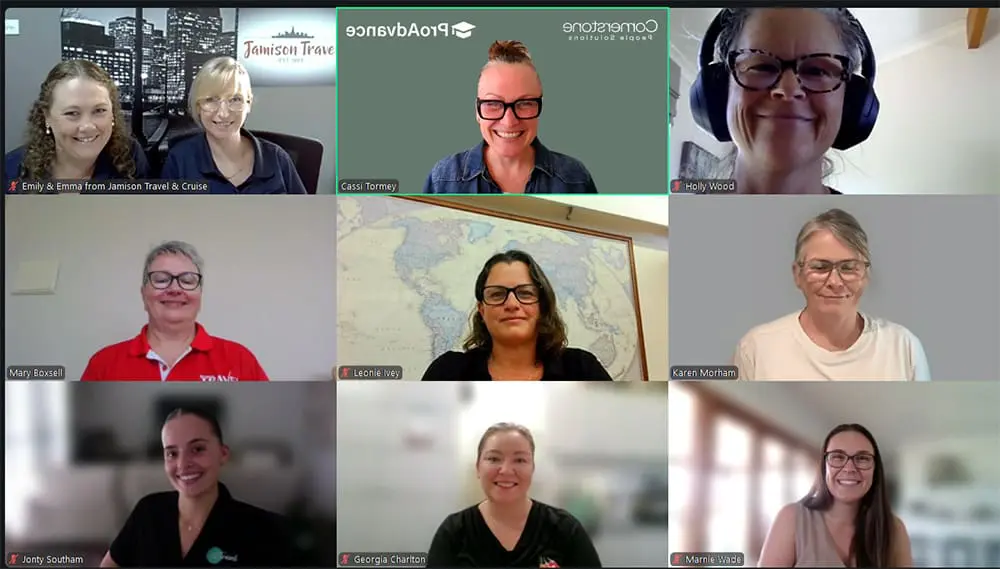

The inaugural intake of 12 advisors has embarked on the six-month program, a combination of self-paced learning modules and monthly Zoom masterclasses.

Travellers Choice used feedback from successful members to shape the program, incorporating recurrent themes, such as the cost of running a travel business and people management skills, into the course.

Travellers Choice General Manager – Sales Nicola Strudwick said the new training course will give ambitious consultants “the skills and confidence they require to take the next step on their career progression” into a management role or running an agency.

“ProAdvance is not just about developing capabilities for today, it’s about deliberately shaping the leaders of tomorrow,” she said.

“We are delighted to have also had several travel agency owners enrol because they see an opportunity to drive growth by enhancing their own business acumen.

“ProAdvance gives consultants a more nuanced commercial understanding by introducing them to practices, such as cash flow forecasting, generating P&L reports and setting sophisticated budgets, sales targets and marketing strategies.

“Ultimately, we want to ensure that when people are ready to step into management roles – or expand their business – they are more than equipped to do it,” she said.

The initiative also complements its free, three-month ProStart training program for new entrants to the travel industry. Launched in 2025, Strudwick said almost 30 advisors have graduated from ProStart.

“The program has significantly reduced the time required for new recruits to become genuine assets to a business. And it has helped ensure new starters stay in the industry by making them feel supported and providing them with a pathway to further qualifications,” she said.

Find out more at travelagentschoice.com.au