A couple of months ago, CATO Chair Dennis Bunnik wrote a piece calling for collective ideas on industry-wide reform for a post-COVID-19 world. Two key topics, in particular, came up time and time again in the feedback – consumer protection and the reform of ATAS. Today, CATO has released a discussion paper with the aim of starting a dialogue for unified positive change.

FACT: The travel industry is enduring its worst-ever crisis, with continued pain and distress across the supply chain and indeed, the world.

We are an industry in Australia that has been decimated in job and livelihood losses while becoming wholly disconnected and discouraged at the lack of any clarity from our leaders as to how and when we will navigate our way out of this mess.

To top it all off, travel agents and suppliers have continued to be battered by negative public sentiment around the miseducation of refunds and the collapse of travel companies such as STA Travel last week.

But while the doom and gloom are there for all to see, one major positive is seeing the strength and resilience of our industry and people stepping up to lead, rebuild and look ahead, despite still being in the midsts of the worst time ever.

The Council of Australian Tour Operators (CATO) has today released a discussion paper with the intention of sparking dialogue around what they say are the two main topics of feedback they have received since CATO Chair Dennis Bunnik called for industry-wide input a couple of months ago.

Namely, Consumer protection and the reform of ATAS.

CATO says the document’s intention is to spark debate and discussion on these topics and stakeholder feedback will be sought from industry participants.

If the interest exists, CATO will then jointly seek to develop a more detailed plan to see how these reforms can be implemented.

There’s a lot here, so we thought the best way to share this document was in full.

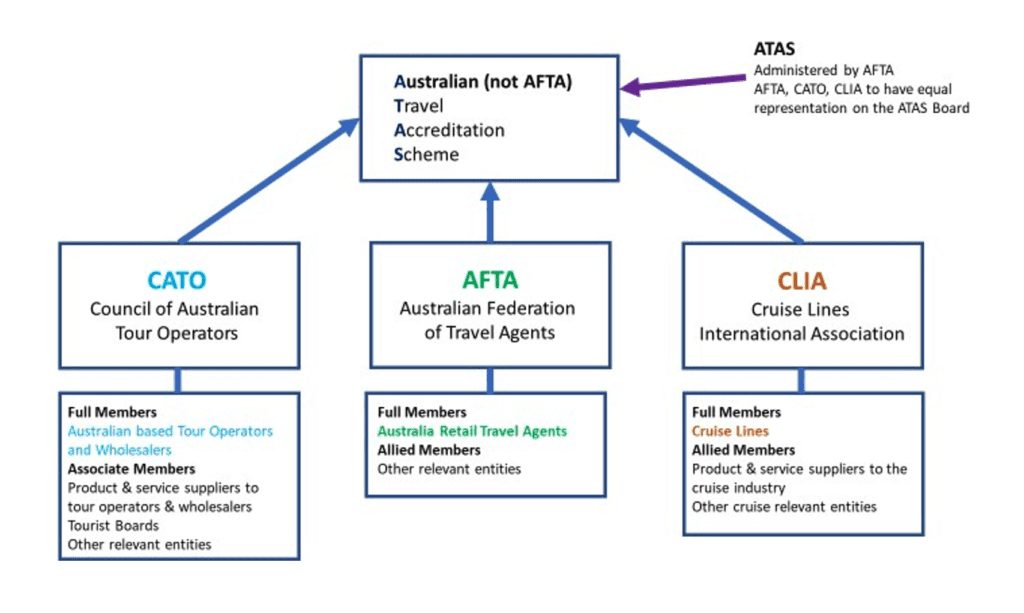

1) ATAS reform – what could that look like?

Key suggested points

- ATAS becomes the Australian Travel Accreditation Service (currently AFTA Travel Accreditation Scheme).

- ATAS will provide accreditation services for AFTA, CLIA and CATO with each accreditation program tailored to the needs of the sector but all under the ATAS brand.

- ATAS will be administered by AFTA and run out of the AFTA office however will operate as an independent body with an independent board. AFTA, CLIA and CATO to have equal representation on the ATAS board in addition to independent experts.

- There will be a standard base accreditation criterion that is common across all three associations with additional sector-specific requirements signed off by each individual association.

- ATAS fees (based on turnover) will be standard across all 3 associations with a license fee/royalty paid to AFTA to help fund industry lobbying efforts.

- Standardised fees for ATAS accreditation will ensure that members with diversified businesses do not shop their accreditation between associations.

- ATAS accreditation is separate from association membership – this means that a diversified entity could be a member of CLIA, CATO and AFTA but would only be accredited with ATAS via one of those Associations.

Why is this a good idea?

- The plan will significantly broaden ATAS’s membership and bring many non-accredited businesses into the fold.

- ATAS will become more relevant for non-travel agents than it is now.

- AFTA revenue through the licence fee/royalty will increase.

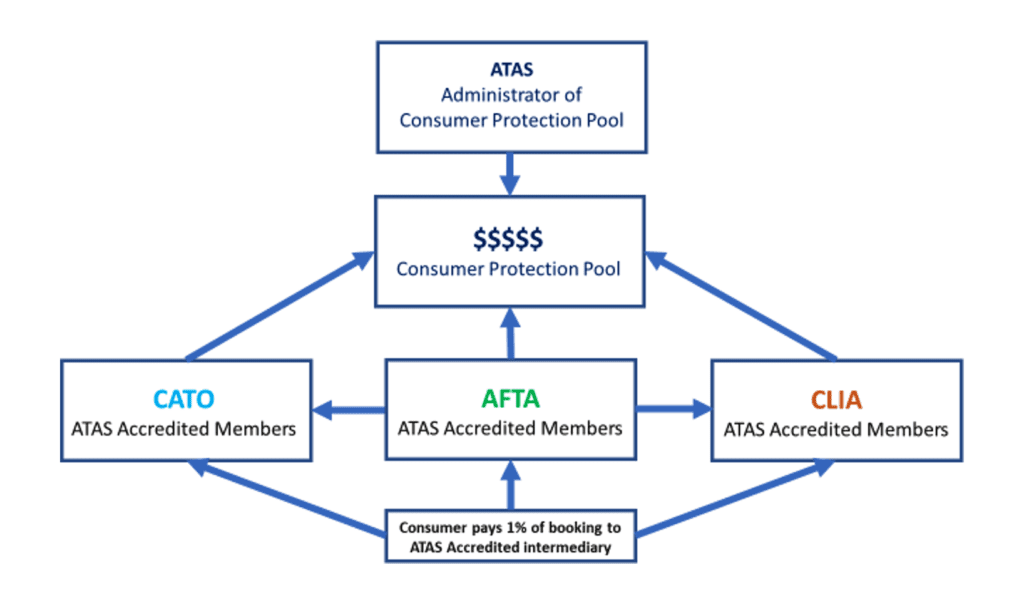

2) A new Consumer Protection Scheme (CPS)

Key suggested points

- Create a user pays insurance levy to protect consumers against Australian based tour operator/wholesaler/cruise line/supplier or agent insolvency.

- Available only through ATAS accredited entities with levy collected and policy issued by an entity who receives the money from the client. This ensures coverage for both trade and direct bookings (NB: Could be via the ATAS retailer or direct with ATAS tour operator, wholesaler or ATAS Cruise Line.

- Levy to be determined but for discussion purposes let us suggest 1% of the booking value.

- Cover for all services purchased through the ATAS accredited entity – thereby encouraging bookings through ATAS accredited businesses and encouraging more businesses to become accredited.

- Coverage is for consumers only (not corporate bookings).

- Coverage is compulsory for international travel, potentially voluntary for domestic travel.

- Initial set up & reserves funded by the government, but this will be refunded as soon as reserves hit predetermined levels.

- Scheme to be administered by ATAS but with independent oversight.

Why is this a good idea?

- Survival of the Australian travel industry is crucial post-COVID

- Provides key support for the Australian travel industry as coverage is only available through ATAS Accredited Entities.

- Provides comprehensive consumer protection for monies paid for travel services which are currently not available. This means during the next crisis there will be no consumer concern about travel credits being worthless due to supplier failure.

- Provides industry protection against credit card chargebacks.

- Increases overall professionalism within the Australian travel industry by giving all travel agents, tour operators, wholesalers and cruise lines a very compelling reason to become accredited.

- By being accredited these businesses will have access to industry-standard terms & conditions, professional development and have their financial health monitored.

- Higher levels of industry professionalism and comprehensive consumer protection in case of insolvency will significantly reduce travel industry complaints to the ACCC.

- Removes a significant cost and risk for travel agents in the event of supplier collapse – the Tempo/Bentours collapse cost the travel agency sector at least $15m.

- Allows travel agents to offer consumers a significant advantage for booking through them rather than direct with airlines or overseas suppliers. Insurance coverage is not available for airline direct bookings nor through overseas-based (non-ATAS) suppliers booked by clients direct.

- This scheme fixes the fact that consumer protection is not provided by the current ATAS program.

- This scheme will broaden the reach of ATAS and increase funds available to AFTA allowing for greater levels of government lobbying by the travel industry.

- This scheme will be run by the travel industry as part of the industry’s self-regulation for the benefit of consumers.

- Will ensure a far better relationship with ACCC going forward and eliminates the risk of future Government regulation.

Who and what is covered?

- Only new bookings made after the scheme has been launched and where the insurance levy has been paid will be covered.

- Coverage is for insolvency only.

- Coverage extends to the entire booking in the event that the AAE (ATAS Accredited Entity) or the airline goes insolvent.

- Coverage is limited to the value of the insurance/initial services paid – it will not cover replacement services which may cost more.

- Coverage is for personal travel only. NOTE: detailed discussions required with corporate travel sector. Initial thinking here is that due to high volumes and low margins most corporate bookings are automated or process-driven. Adding an additional layer is unlikely to be feasible from a cost/benefit perspective. Further discussion with the corporate travel sector is required with protocols developed for part business-part leisure bookings.

- Coverage would be compulsory for all international travel booked through AAEs.

- Coverage would be highly recommended for all domestic travel booked through AAEs.

Policy issuing

- Policies can only be issued by AAE’s – accredited members of AFTA, CLIA and CATO.

- The policy is issued by the AAE dealing directly with the customer. This ensures coverage for all bookings whether booked through a travel agent or direct with CLIA or CATO member.

- The policy is issued at the time of booking when a client pays the deposit. The estimate is made of total booking value and policy is issued for the total amount. Policy to be easily increased if subsequent changes increase booking value – policy linked to AAE booking number.

- Policy issues to be as automated as possible – ideally through a simple online portal with connectivity through GDS or reservations/mid-office systems.

- Once issued the insurance policy to be emailed to both client and booking consultant.

- Payment of policies will be via agent credit card or automated direct debit.

How much would it cost?

- Detailed modelling by professional actuaries will need to be undertaken to determine the following: exactly how much start-up funding is required, the annual cost of running the scheme, level of reserves required and the amount of the insurance levy clients will need to pay in order to ensure sufficient reserves in case of a major collapse.

- For discussion and planning purposes a proposed of 1% of gross booking value can be used. This should allow reserves to be built and cover the cost of administrating the system.

- Levy levels would be reviewed on a periodic basis with a view to reducing them as the level of reserves grow.

- Government funding will be required for the initial set-up and to underwrite the reserves. Once reserves reach pre-determined thresholds these funds can be repaid to the Government.

- Government funding can be sought via the various COVID recovery schemes as this Consumer Protection Scheme will help re-instil consumer confidence in the Australian travel sector thereby aiding recovery and job growth.

Administration & Corporate Governance

- The scheme will be administered by ATAS but overseen by a board made up of industry (AFTA, CATO, CLIA) and non-industry leaders (potentially including representatives of ACCC/Govt).

- Management of the funds raised, and processing of claims can be outsourced to an insurance company.

- Significant additional work required in this area to determine legal/regulatory requirements.

- Further discussion required around the impact on saving Australian jobs where the consumer is supporting the scheme – beneficial to AU economy.

To download the full report, please click here.

What do you think about the points raised?

To confidentially share your ideas and feedback on the discussion paper, please email the following people.

CATO Managing Director Brett Jardine Bjardine@cato.travel

CATO Chair Dennis Bunnik: dennis.bunnik@bunniktours.com.au