How do you pay for your holidays? Recent research has revealed that two in five (40.4 per cent) Australian adults don’t pay for their getaways upfront, leaving a whole bunch of Aussies in debt after their holidays.

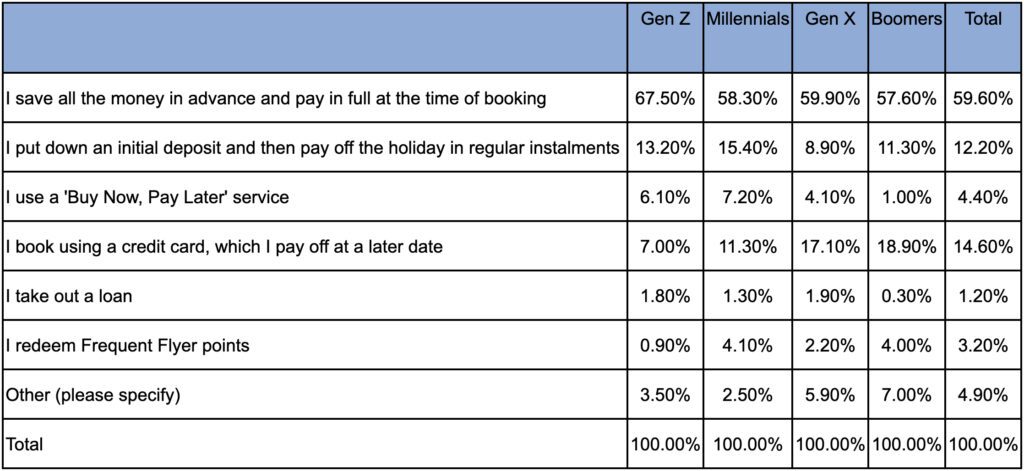

While the majority (59.6 per cent) of respondents in the Compare the Market study said they pay for their holidays in full at the time of booking, many travellers choose to use their credit cards (14.6 per cent), put down a deposit and pay off the rest later (12.2 per cent), or use a ‘Buy Now, Pay Later’ service (4.4 per cent).

Others (3.2 per cent) redeem loyalty program points, while a very small number (1.2 per cent) take out a loan.

Polling over 1,000 Australians, the study found that the older you are, the more likely you are to use a credit card to pay for bookings. As such, boomers are the most likely (18.9 per cent of respondents) to use their credit cards to pay for holidays, followed by GenX-ers (17.1 per cent), Millennials (11.3 per cent) and Gen Z-ers (7 per cent).

Perhaps surprisingly, Gen Z travellers are the most likely (67.5 per cent) to pay in full at the time of booking, followed by GenX-ers (59.9 per cent), Millennials (58.3 per cent) and Boomers (57.6 per cent).

Dipping into debt

“The pandemic has left many people feeling overtired, overworked and ready to dive into the nearest swim-up bar – but not everyone can afford to do this after a record run of rate rises and exploding costs across the board,” Compare the Market general manager of general insurance and travel insurance expert Adrian Taylor said.

“If you’re paying for a holiday on a credit card, you risk spending way more than you need to.

“You can get charged a hefty interest rate and might have to pay an additional fee if you miss a payment.”

“Everyone has that one friend who has gone on holidays by paying for everything on the credit card, and then they come home with debt lag and spend ages trying to pay it off.”

Things to consider

Taylor suggests that Aussies who can’t pay upfront for a holiday consider if they can really afford to go away.

“Or are you happy to pay off the holiday when you get back?” he said.

“If your answer is no to those questions, then the dreamy holiday destination has surely turned sour.”

While “debt lag” should be avoided, he added “having a break for your mental health is important too”.

“So, if borrowing for a holiday is something you think is a necessity, you should give some thought to what the repayments will be, how long it will take you to pay the holiday off, and whether it will be paid off by the time you’ll be ready for another holiday,” he remarked.

“You don’t want to be paying off multiple holiday loans, as this can easily get out of hand.”

Another study has revealed the ways in which Aussie travellers will cut back on costs while they’re on holiday so they can afford to travel.

According to research into discretionary spending habits and priorities, almost half of global consumers (47 per cent) said that overseas travel is a top priority and will spend 28 per cent more on holidays than last year.