In a year that witnessed both challenges and triumphs, the Qantas Group saw profits fall in FY24. The company reported an Underlying Profit Before Tax of $2.08 billion and a Statutory Profit After Tax of $1.25 billion. These represented year-on-year decreases in profit of 16% and 28%, respectively.

While overall earnings dipped compared to the previous year due to lower fares and increased spending on customer initiatives, the group’s domestic operations provided a bright spot.

Domestic bliss

Group domestic delivered $1.361 million in underlying earnings, supported by Qantas and Jetstar’s dual brand strategy.

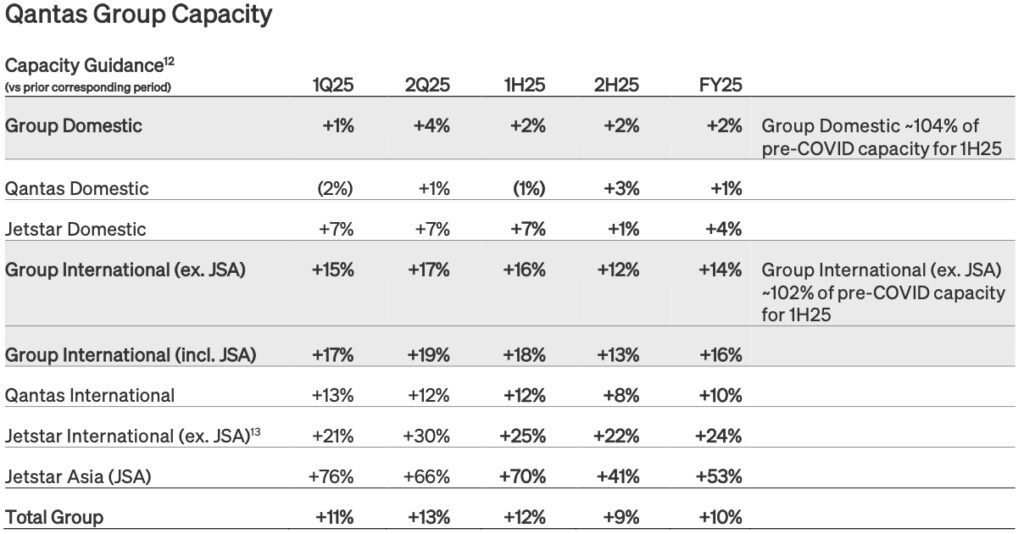

Capacity-wise, Jetstar grew its domestic network by 15%, while Qantas’ capacity rose by 1%. Corporate and business travel offset a downturn in demand for domestic premium leisure travel.

Meanwhile, the resources sector continued to grow, with charter revenue up by a healthy 18%.

Qantas and Jetstar both saw improvements in operational performance and customer satisfaction, thanks to investments in their operations, enhanced food and beverage offerings, frequent flyer seats and a revamp of Qantas’ digital platforms.

Specifically, Qantas’ on-time performance improved significantly, while mishandled baggage also decreased. Its domestic Net Promoter Score increased by 24 points.

The group also provided free flights to over 45,000 Bonza and Rex customers.

According to the group, the addition of 11 new aircraft, including Jetstar’s A321neo long-range and QantasLink’s A220s, contributed to better operating costs, passenger comfort, and reduced carbon emissions.

“The investment in operational reliability and customer initiatives delivered an improvement in on-time performance and customer satisfaction with Qantas ending the year as the most on-time major domestic airline,” Qantas Group CEO Vanessa Hudson said.

Fares hit international profit

On the international front, Qantas returned to pre-COVID capacity in May 2024, but earnings were impacted by increased competitor capacity and downward pressure on fares. In total, group international earnings moderated to $755 million in underlying profit.

Despite this, popular routes like Perth-London and new services such as Perth-Paris gave the airline confidence in expanding its non-stop flights to London and New York by mid-2026.

Jetstar’s international network also saw significant growth, with new A321LR jets expanding short-haul international service to Fiji, Bali, and other ports and B787s lifting long-haul destinations like Japan and South Korea.

“Our focus this year has been getting the balance right in delivering for customers, employees and shareholders while building a better, stronger Qantas Group,” Hudson remarked.

“Restoring trust and pride in Qantas as the national carrier is our priority, and while there’s more work to do, we’ll get there by consistently delivering to our customers and people in the future.

“This result shows the underlying strength of the Group’s integrated portfolio. Qantas benefited from increased corporate and resources travel and ongoing high demand for international premium seats while Jetstar delivered its highest result as it grew to meet increased demand from price-sensitive leisure travellers and saw the benefits from its new aircraft.”

Record redemptions

Qantas Loyalty had a record year with an underlying profit of $511 million, thanks to major program improvements and the introduction of Classic Plus Flight Rewards, which offers frequent flyers more redemption opportunities.

A record number of points were earned and redeemed during the year, and Qantas Loyalty also expanded into holiday packages through TripADeal.

“The introduction of Classic Plus, with millions of frequent flyer seats, helped drive member engagement and strong earnings for Qantas Loyalty,” Hudson said.

In addition, the flying kangaroo offered 23,000 non-executive staff $500 travel vouchers on top of the $500 voucher provided earlier in the year, totalling $1,000 in rewards.

Outlook positive

Looking ahead, Qanta says it remains optimistic. With stable travel demand, it plans to expand its fleet further with 20 new aircraft in the coming year.

“Our strong financial performance and balance sheet will allow us to continue to invest in our largest ever fleet renewal program, which will benefit our customers and people, as well as delivering shareholder returns,” Hudson said.

“These investments come at a time when Australians are continuing to prioritise travel over other spending categories, with intention to travel over the next 12 months remaining high.

“I want to thank every one of our people for the professionalism, hard work and commitment to delivering for our customers.”

Qantas says it is well-positioned to navigate the challenges of the coming years while delivering value to its shareholders, to whom it will distribute $400 million this year.

The airline also continues to invest in sustainability initiatives, aiming for a 25% reduction in net emissions by 2030.