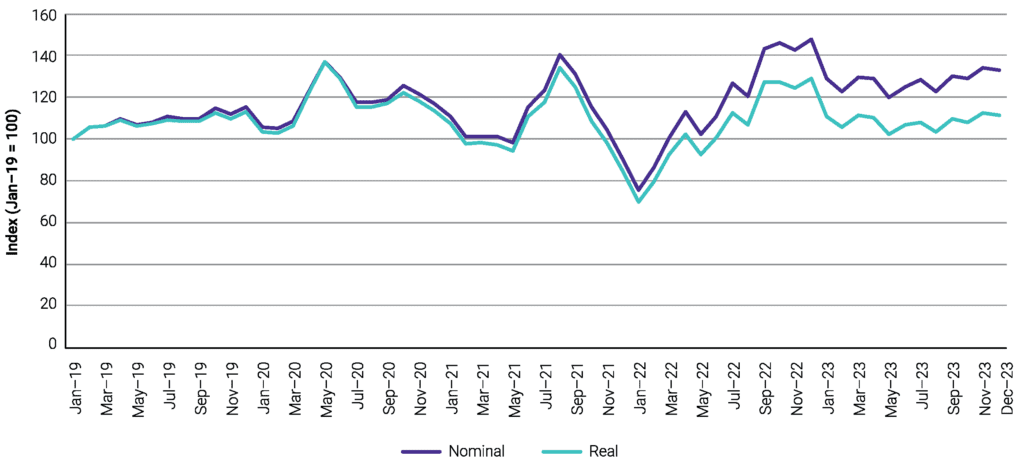

In good news for those who like cheaper air travel (and who doesn’t?), domestic airfares appear to be heading in the right direction after they finished lower at the end of 2023.

After reaching record highs in late 2022, domestic airfares fell on the whole last year, with prices across all fare types falling on average by 13.4 per cent in December 2023 compared to December 2022, according to new data from the Australian Competition and Consumer Commission (ACCC).

The ACCC’s latest ‘Domestic Airline Competition in Australia’ report shows that average revenue per passenger, in real (inflation-adjusted) terms, in December 2023 was also below pre-pandemic levels (December 2019), but “best discount” economy airfares remain higher.

“Travellers finally saw some relief from high airfares last year, which was consistent with cheaper jet fuel prices and slightly lower demand for domestic air travel,” ACCC Chair Gina Cass-Gottlieb said.

Reliability woes

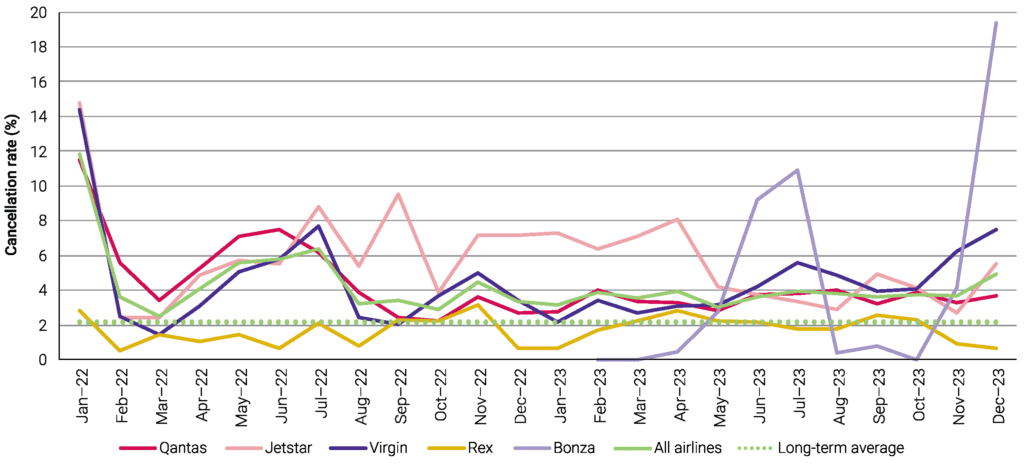

Despite this relief, flight cancellations and delays remain high – at least, when compared to long-term averages.

According to the report, five per cent of flights were cancelled in December 2023, which is more than double the long-term average, while just two in three flights (63.6 per cent) arrived on time, compared to a long-term average of 81.1 per cent.

“The persistently high rates of cancellations and delays compared to long-term averages in the second half of last year were clearly disappointing for consumers,” Cass-Gottlieb said.

Airservices Australia attributed some of the poor performance to a shortage of air traffic controllers.

Meanwhile, after the ups and downs of the pandemic, the number of passengers and available seats in domestic airlines seems to be levelling off.

Around 4.9 million people flew domestically in December 2023, which is roughly 94 per cent of pre-pandemic (December 2019) levels, while load factors have generally sat between 90 and 95 per cent since December 2022.

Reflecting about 95 per cent of the capacity in December 2019, carriers’ combined seats in December 2023 totalled six million.

“The last four years have been a particularly unstable period for the domestic airline industry,” Cass-Gottlieb said.

“Although passenger levels and capacity have not quite returned to pre-pandemic levels, the industry appears to have largely moved on from its recovery phase and is now exhibiting more typical seasonal trends.”

Making fares fairer

Elsewhere, the ACCC pointed to the benefits of increased competition on routes for airfares, singling out the Gold Coast-Melbourne route, which has seen four different airlines – Qantas Group (including Jetstar), Rex and Virgin Australia – vying for business for the first time.

Around 50 per cent of all domestic passengers in December flew on routes with at least three competing carriers.

“When more airline groups compete on a particular route, consumers benefit from lower fares,” Ms Cass-Gottlieb said.

“Qantas and Jetstar, however, continue to fly over 60 per cent of domestic passengers, representing a very high market concentration.”

Meanwhile, the ACCC has recommenced its monitoring and reporting of domestic airline direction, with the new Domestic Airline Competition in Australia report the first since it was reinstated.

The downward direction of domestic airfares is consistent with the drop in international fares. Read our story on this decrease.

According to Department of Infrastructure, Transport, Regional Development, Communications and the Arts (BITRE) data, more than half of flights run late on Australia’s least punctual routes.

And these flight cancellations and delays aren’t just a source of frustration for flyers who only want to get where they’re going in a reasonable timeframe; they have serious economic consequences, recent research commissioned by ATIA has confirmed.