‘Fee-free’ prepaid travel money cards may sound like a great deal on an overseas holiday, but new research shows not all travel cards are created equally – and some may end up costing travellers more by offering lower exchange rates.

Australian financial comparison site Mozo analyssed six prepaid travel money cards and 175 debit cards and found travel money cards marketed as ‘fee-free’ may not always offer the best value.

It found some travel money cards that charge fees deliver a better return once exchange rates are considered.

Travel money cards compared

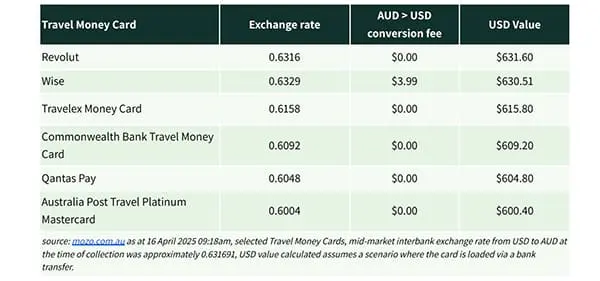

Mozo compared six popular prepaid travel money cards to see how many US dollars Aussies would receive from an AUD$1,000 transfer.

Despite all cards being assessed on equal terms, there was a $31 difference between the highest and lowest amounts received.

Other factors to consider include prepaid travel cards that charge extra for conversion on weekends, BPAY load fees, ATM withdrawal limits, inactivity fees and even closure fees that can see costs add up for fee-free cards.

Using debit cards for travel

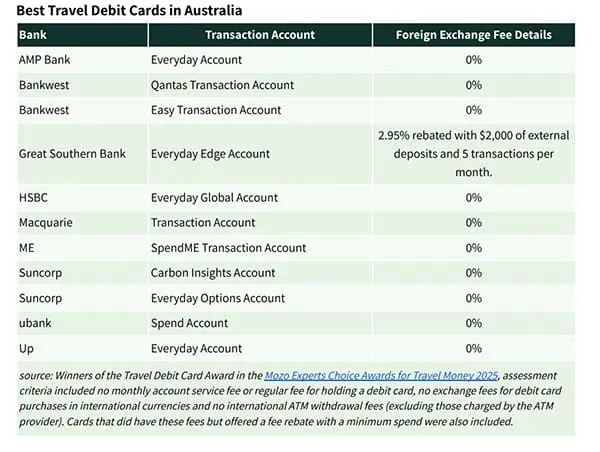

For travellers who prefer to use their everyday debit card instead of a prepaid travel card, Mozo’s analysis of 175 fee-free debit accounts from 74 providers reveals just nine debit cards charge no international purchase, ATM or foreign exchange (forex) fees.

Most debit cards analysed apply an average forex fee of 2.67 per cent up to the highest forex fee at 3.65 per cent.

Aussies paying the average forex fee could save as much as $133.50 on a $5,000 spend or $267 on a $10,000 spend by opting for a card that does not charge these fees.

In addition to forex fees, many debit cards can also charge international ATM withdrawal fees, ranging from $0 to $5 per transaction with an average international ATM fee of $2.91.

Mozo personal finance expert Rachel Wastell said there are pros and cons with using travel money cards and debit cards while travelling and it pays to read the fine print to get the best deal.

“A lot of Aussies assume ‘no fee’ means best value, but when you look at the exchange rate being offered, that’s not always the case. You could be losing money through the rate instead of an obvious upfront charge, and unless you do the maths, you might not even realise,” she said.

“Avoid foreign exchange fees, any charges for international ATM fees and of course, monthly account keeping fees if you are opting to use a debit card while travelling.”

Find out the best and worst destinations for the Australian dollar right now here.