Despite “challenging” market conditions, Flight Centre Travel Group (FLT) has upgraded its Total Transaction Value (TTV) and profit guidance for the 2023/24 financial year (FY24), in good news for Australia’s largest travel agency group.

With travel enjoying a massive year in FY24, following a recovery year in FY23, FLT now predicts an underlying profit before tax (PBT) in the range of $316 million to $324 million, which is a 130 per cent increase over the prior year’s $138.8 million (adjusted for amortisation).

Based on preliminary trading results, FLT expects TTV to be around $23.7 billion, which matches the record FY19 result and reflects a $1.7 billion year-on-year increase, despite significant airfare deflation, especially from January to June 2024 (H2).

On top of this, Flight Centre Travel Group anticipates a 1.3-1.4 per cent underlying profit margin (PBT as a percentage of TTV), which is a big increase on the 0.6 per cent seen in FY23.

Elsewhere, the company reports a strong outlook for FY25, showing progress towards a group-wide two per cent margin target.

FLT’s updated profit range excludes about $4 million in trading losses from the closure of the Discova Central Americas (DCA) destination management company and aligns with the treatment of its other discontinued business, wholesaler GoGo.

FY24 profit results exclude non-recurring items for clarity. This includes impairments and restructuring costs relating mostly to StudentUniverse, which as part of BYOJet and Aunt Betty aims to break even in FY25.

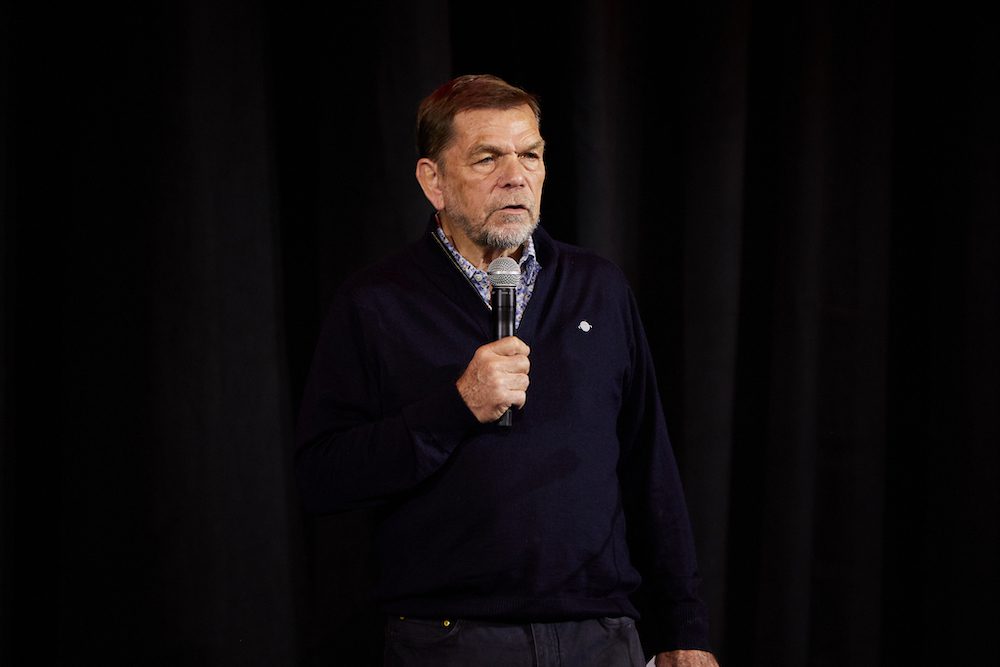

Flight Centre Travel Group Managing Director Graham Turner said growth comes on the back of consumers prioritising travel in their budgets.

“FLT is a diverse global business with a resilient customer base, spanning the leisure and corporate travel sectors, and a proven track record of delivering year-on-year TTV growth,” he stated.

“While market conditions were challenging during FY24, we again delivered solid TTV growth as customers prioritised travel over other areas of discretionary spend.”

However, Turner flagged that y-o-y growth was tempered by “significant airfare price deflation” during H2 – which he added would ultimately be good for travel.

“Average international airfares decreased by 6 per cent globally during the 2H, compared to the FY23 2H, and by almost 13 per cent in Australia to offset the circa 10 per cent growth we recorded in ticket volumes in Australia during the six months to June 30,” he remarked.

“While this has slowed our TTV growth, we welcome this deflation and believe it is a potential tailwind in the months ahead, given it is likely to stimulate further demand for international travel.

Turner also highlighted how the Flight Centre Travel Group would deliver “the same level of sales with about 65 per cent of our FY19 workforce, plus an expanding network of independent travel agents and agencies”.

“This underlines the positive returns we have started to see on the investments made during the pandemic to create a more productive and efficient business, while maintaining the assets and customer value propositions that have underpinned our long and consistent sales growth record,” he said.

“As a result, we are now making meaningful progress towards our target of delivering a 2 per cent underlying profit margin, with revenue margin trending upwards and cost margin stable.

“We expect further improvement in these key metrics in the near-term, particularly as the corporate business’s productive operations initiative – a body of work that we have invested significantly in during FY24 to deliver future productivity and service benefits – gains traction.”

Sales-wise, Turner said corporate business “continues to out-perform, delivering another year of record TTV and finishing FY24 about 35 per cent larger in sales terms than FY19”.

This comes “despite customer activity in the sector globally still being about 20 per cent below pre-COVID levels”.

“The global leisure business is also recovering strongly, following a major transformation initiated just prior to the pandemic, and is now more efficient, more productive and more profitable than it was pre-COVID,” the FLT boss said.

In February, Flight Centre Travel Group reported TTV of $11.3 billion for the first half of FY24, representing a 15 per cent rise on the year before and its second-best start to a year ever (behind FY20).

Last year, the company reported a strong FY23 result, underpinned by a more than two-fold increase in total sales, with its leisure and corporate arms delivering more than $10 billion each in annual total transaction value (TTV) for the first time.