Flights between Australia’s major cities have become pricier and a bit more crowded, according to the latest Domestic Airline Competition report from the Australian Competition and Consumer Commission (ACCC).

Since Rex withdrew from these routes on 31 July 2024, domestic airfares between major cities have spiked by 13.3 per cent to September, the report found. Fewer flights and fewer airline choices seem to be behind the price hikes.

The ACCC reports that the number of seats on key metro routes has fallen by six per cent, while passenger numbers have stayed about the same, resulting in fuller, higher-cost flights.

Most of these routes are now operated by just Qantas and Virgin Australia, covering 98 per cent of domestic traffic.

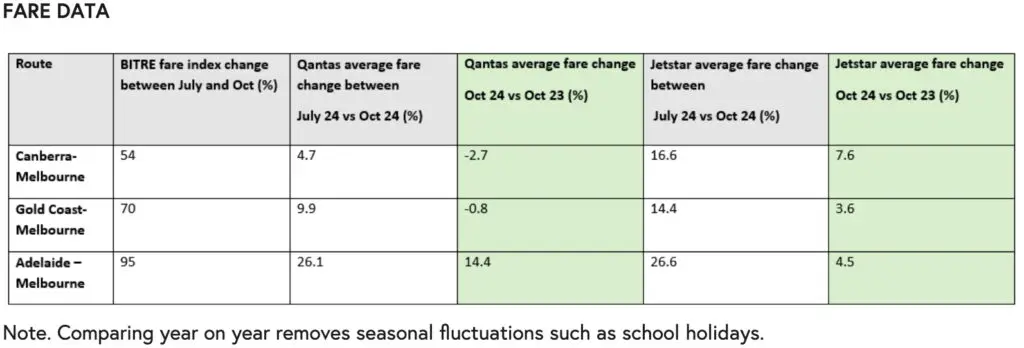

When it comes to the popular “best discount economy” fares, prices have taken quite a leap. Adelaide to Melbourne fares have nearly doubled, by a whopping 95 per cent to $296, while Melbourne-Gold Coast is also up by a massive 70 per cent to $432.

Elsewhere, Canberra to Melbourne also saw a steep increase, rising 54 per cent to $298.

This pattern appears to be the opposite of what’s happening with international fares, which, per FCM Travel and Corporate Traveller data, shows the average cost of an international economy airfare departing Australia fell by an average of 5-10 per cent from July-September 2023 to July-September 2024.

Meanwhile, the average domestic cancellation rate improved to two per cent in September, with Rex leading the way in reliability, boasting a 1.2 per cent cancellation rate, followed by Jetstar (1.3 per cent), Virgin Australia (1.4 per cent) and Qantas (2.8 per cent).

The average on-time arrival rate rose slightly from 71.1 per cent in July to 75.5 per cent in September 2024.

ACCC Commissioner Anna Brakey said recent airfares have risen since Rex stopped flying 11 of 23 city-to-city routes. And with fewer airlines competing, prices have gone up.

“While we also typically see a seasonal peak in air travel in September due to major sporting events and school holidays, there were additional pricing pressures this year,” Brakey stated.

“Passengers were no longer able to access the lower fares that Rex offered, and airline seating capacity decreased following Rex’s exit. This in turn has contributed to higher airfares.”

The ACCC boss also warned of “significant longer-term impacts on the domestic aviation sector” in the wake of Rex’s demise.

“The domestic airline industry has become even further concentrated, and it may be some time before a new airline emerges to compete on popular services between metropolitan cities, with normal barriers to entry and growth exacerbated by aircraft fleet supply chain issues and pilot and engineer shortages,” Brakey remarked.

“With less competition, there is less choice for consumers and less incentive for airlines to offer cheaper airfares and more reliable services.”

Average airfares down

While all of this makes for some gloomy reading for travellers, Qantas Domestic CEO Markus Svensson said the report doesn’t truly reflect the “average fares customers are actually paying”. He can even attribute at least part of the rise to the recent Coldplay tour.

“The data is from the Government’s monthly fare monitoring which expressly states that it does not measure ‘average fares paid by passengers’,” Svensson stated.

“It is a snapshot of the lowest fares available to purchase on a particular day three weeks prior to travel and does not factor in events which may impact demand and fares.

“The day selected in the latest report was 31 October, which is when Melbourne was hosting Coldplay. As such, demand was significantly higher on flights into Melbourne which means lower fares were snapped up early and the fares left available to purchase three weeks out were higher than usual.”

Importantly, the Qantas Domestic boss said the average fare rise on certain routes between July and October was “significantly lower” than some think.

“If you look at fares in July to September this year compared to the same period last year, airfares across the industry have increased broadly in line with inflation,” he remarked.

“These increases were occurring while Bonza and Rex were still operating on domestic routes.

“On routes where there are capacity reductions, there will generally be less lower fares available and we are looking at how we can add more capacity where we can.”

Until then, what does all of this mean for you and your clients on these routes? Consider alternative routes, think outside peak times and become a pro at unearthing those hidden flight deals, for starters.

Meanwhile, the Australian Airports Association (AAA) says the airfare spike raises alarm bells for domestic air travel.

“This report shows why it’s critical to pull all available levers to improve the system as quickly as possible, such as slot reforms at Sydney Airport,” AAA CEO Simon Westaway said.

“This is about making the domestic aviation sector attractive for investment to ultimately deliver greater choices and lower airfares for the flying public.

To read the full ACCC report, click here.

Another recent study found that travellers may face higher holiday season airfares, showing large price differences between the cheapest and priciest days to fly in December.