In its first report card under the leadership of CEO Vanessa Hudson, the Qantas Group has reported a $1.25 billion underlying profit before tax (PBT) for the first half of FY24.

According to the group, earnings were 13 per cent down on the record $1.43 billion it achieved in the same period of FY23, due to lower fares and a rise in capacity.

But travel demand remains “strong across all sectors”, the company says, with leisure travel booming and business travel almost back to pre-pandemic levels.

Based on available seat kilometres, total flying grew by 25 per cent, with the group’s airlines carrying 3.3 million more passengers than in H1 2023.

Overall, lower fares led to lower revenue per seat kilometre, resulting in an approximate $600 million decrease in profit. But this was offset by around $485 million worth of extra flying.

In the six months to 31 December 2023, Qantas International grew capacity by 39 per cent thanks to the return of another A380 and a new B787. Qantas is now operating more international routes than before COVID.

Qantas Domestic added five per cent more capacity in H1, driven by the continued comeback of business travel and premium leisure sectors. PBT for Domestic was $641 million, an 18 per cent decline on H1 2023, but still significantly above FY19 levels.

Jetstar jumps

Meanwhile, Jetstar increased international capacity by 38 per cent year-on-year, as it added routes like Melbourne-Fiji and Brisbane-Tokyo. Driven by leisure demand, Jetstar International grew its PBT to $150 million, despite lower fares.

With 15 per cent more capacity and less operational disruption, Jetstar Domestic grew its PBT by a massive 35 per cent to $175 million.

Big win for Loyalty

Elsewhere, Qantas Loyalty is showing massive growth, with PBT increasing by 23 per cent year-on-year to $270 million and membership expanding to 15.8 million. This H1 performance enabled Loyalty to reach its earnings target of $500 million per annum six months early.

Notably, Qantas Frequent Flyers’ intention to spend on travel in the next six months is much higher than spending intentions in other categories.

Qantas Hotels and Holidays bookings also showed significant growth, rising by roughly 30 per cent compared with H1 2023, while TripADeal bookings grew over 60 per cent.

What’s in store for flyers?

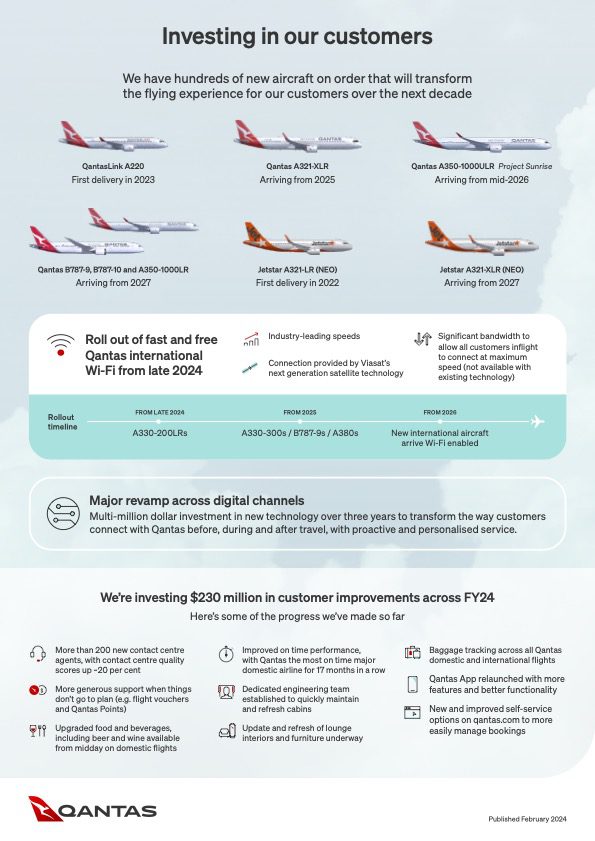

Qantas Group also announced several major investments including an expedited rollout of its free wifi on international flights (due to start at the end of 2024), a major overhaul of its digital platforms (including an enhanced Qantas app and a new Qantas website from mid-2024) and a double Qantas Points/Status Credits initiative for members.

Qantas also today revealed the interiors of its new A220 aircraft (with Karryon joining a special launch flight to Uluru today… so stay tuned).

The group received eight new and mid-life aircraft during H1 2024, with 14 more planes expected to arrive during H2.

It has also just announced eight more A321XLRs for Qantas Domestic in addition to four extra mid-life A319s for Western Australia.

However, manufacturing delays for the first A321XLR has pushed the plane’s arrival back three months to early 2025.

Additionally, Qantas International’s Project Sunrise will be postponed by approximately six months to mid-2026 on account of a delay in the arrival of the airline’s A350 aircraft.

Meanwhile, driven by the arrival of new aircraft, the group says it will continue to invest heavily in people, including recruitment and training.

To acknowledge the efforts of its employees, some 24,000 non-executive staff members will be given a $500 travel voucher to be used for standby fares for staff, friends and family.

“Journey will take time”

“We know that millions of Australians rely on us and we’ve heard their feedback loud and clear,” Qantas Group CEO Vanessa Hudson said.

“There’s a lot of work happening to lift our service levels and the early signs are really positive. Our customer satisfaction scores have bounced back strongly since December and we have more service and product improvements in the pipeline.

“Having the financial strength to keep investing is key, and that makes the strong performance that all business units had in the first half so important.

Hudson also confirmed a decrease in airfares of “more than 10 per cent since peaking in late 2022”.

“At the same time, we’ve seen a cost benefit from fewer cancellations and delays, and scale benefits as more international flying returns,” she remarked.

“Our people have been instrumental in the initial recovery we’re seeing and I thank them sincerely. The journey we’re on will take time, but the spirit they are bringing is fantastic and it’s made us optimistic about what we can achieve together.

“I want to thank our customers and our partners for their support as we keep working to make the Qantas Group an organisation that everyone is proud of.”