Firstly, the good news: nearly every Aussie jetting off abroad wants to be insured, and travel advisors are the top channel for selling insurance. The bad news is almost half of those travellers are at risk due to overlooked fine print – and that’s just the start.

A study commissioned by the Department of Foreign Affairs and Trade (DFAT) and Insurance Council of Australia has revealed that 95 per cent of Australians who have booked an overseas trip in the next 12 months intend to take out travel insurance – and with over 1 million Aussies departing our shores every month, that’s a lot of policies.

However, DFAT’s Consular State of Play report 2021/22 also shows Australian travellers are taking unnecessary risks.

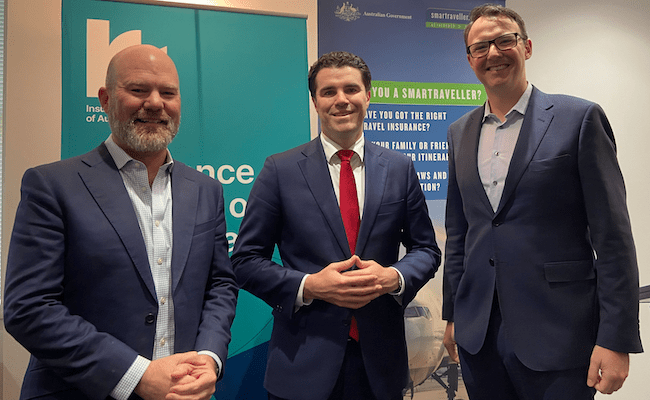

According to the report, which was released in Canberra by Assistant Minister for Foreign Affairs Tim Watts, more than half of those taking out travel insurance risk being underinsured as they have not personally read the fine print of their policy.

So if you’re a travel advisor selling insurance, arguably the most important thing to keep in mind when talking to customers: read the fine print.

Alarmingly, 1 in 10 travellers under 30 reject the idea of insurance altogether regardless of the destination. This is particularly worrying when you consider that up to two-thirds of young travellers may still travel to a destination despite Government advice against it.

It might also explain why during 2021/22, requests for consular support from Australians abroad almost tripled to 34,000, according to Watts.

Number one channel

Australian Federation of Travel Agents (AFTA) CEO Dean Long said travel advisors were doing their part in insuring Aussie travellers would remain covered overseas, “with more than 80 per cent of all international travel booked through one of our member travel agents and tour operators”.

“The report confirms that 95 per cent of Australians who have booked a trip will take out travel insurance and, with our ATAS-accredited businesses the number one distributor of travel insurance, travel professionals can and should be very proud of our role in keeping Australians travelling safely and with the appropriate and essential level of insurance protection,” said Long, who was invited to attend the launch of the report.

“If you can’t afford travel insurance, you simply shouldn’t be travelling. Plus, by booking through an ATAS business, you have the additional confidence of knowing you are dealing with the very best.”

Conducted by Quantum Market Research in July 2022, the study polled 1001 respondents intending to travel overseas in the next 12 months.