In 2011 the Aussie dollar hit US$1.10, it was great for the international Aussie traveller and the agents they booked through.

But it was not as good for incoming tourism and the economy overall.

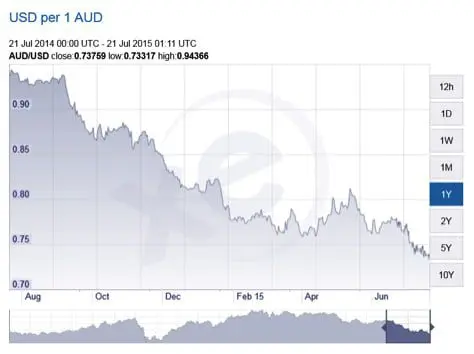

From then on, the dollar started dropping and the tables turned.

Glenn Stevens kept talking the dollar down and the general sentiment was ‘people still have money to spend’. All good, they still travel, we will be fine. What tipping point?

Where are we at today – know your facts

The self-fulfilling prophecy which is the Australian media and Reserve Bank got over excited and said that by years end, the dollar would be at $0.80.

It ended 2014 at $0.90 and it looked like fear mongering that sold ad-space.

Seems their timing was the issue, not the forecast.

The Reserve Bank always wanted $0.75 and they just got it. But for travelers, some are starting to re-think the big overseas trip to something a little more domestic. Not so good for the Aussie agent.

Is it going to go lower?

This data is out of Canada, doom and gloom sells ad-space and this one suggest the Aussie dollar has quite some way to go, heading towards $0.60. It’s the extreme.

The general stats suggest over the next three months the Australian economy will not improve enough to offset an improving US dollar and the exchange rate is going to head towards $0.70.

The realities of everything? People will start reconsidering their travel plans or needing a bit of prompting as to why they should book now. Domestic plans may get more attractive.

Agents will survive, but need to be on the front foot to capitalize and lead the market.

Any strategies that will work?

There are two basic ideas that agents need to get their head around.

Put simply, communicate. Remove uncertainty.

On average for a decent trip Australian travelers book about three months in advance. There is nothing wrong with saying to a traveler ‘booking now might save you 10 percent’. You are doing them a favour. Be a solution. Some suppliers allow you to hold inventory for a short time.

Of course, you can call back the customer and ask them for more money… alternately, you MUST have the conversation about variable pricing up front.

In my experience, it is seldom a conversation which goes well. One way to avoid variable rates is to book and pay now. If you don’t, they won’t be back.

Secondly, be extremely careful on variable rates for travel you have purchased for your pax.

Let’s assume you are working on 10 percent margins. You buy something today on a wholesale variable rate for $1,000 and you expect to sell it for $1,100. If the exchange rate goes from $0.75-$0.70 in the next three months when you go to pay for it, the real cost becomes $1,071.

Your predicted margin of $100 has now become $29.

Can you just ride it out?

The brighter side of the falling dollar is eventually, there will be a general improvement in economic conditions in Australia.

“The RBA’s calculations show that 10 percent depreciation in the real exchange rate will increase gross domestic product (GDP) growth by 0.5-1% over two years. It will also increase the yearly inflation rate by 0.25-0.5% over two years.”

So in other words, wages might go up to offset more expensive travel.

In the short term, things might be tough, but stick with it, people will save more, pay off larger amounts of money on their mortgage because of lower interest rates and that will start coming back.

They might even sell their house to a foreign investor and go see the world.